The era of dynamic, data-driven materiality

Companies are gradually realising that sustainability (or ESG) matters can have a significant effect on a company’s financial performance – and are wanting to integrate these issues into decision-making. That is exactly why the Corporate Sustainability Reporting Directive (CSRD) advocates for a strong, double materiality process; both from a financial and an impact point of view. The rise of strategic analytics platforms (like the Trensition Trendtracker) is proving to be a trusted companion in the new era of double materiality (as applied by Möbius).

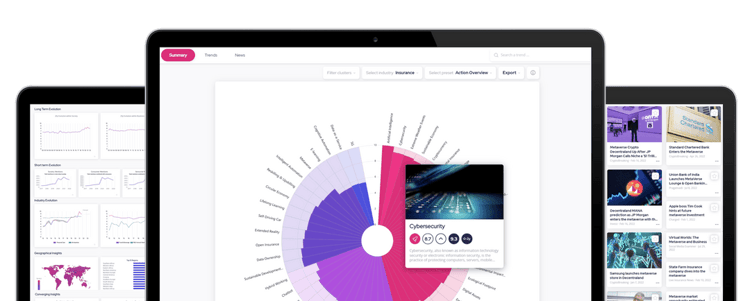

Exhibit: data-driven materiality

Data-driven materiality is the process of using advanced analytics to identify and prioritise ESG issues that are most relevant to a company's business operations and stakeholders. By analysing vast amounts of data from various sources, companies can gain valuable insights into emerging trends and risks, enabling them to make more informed decisions that mitigate the impact and drive or protect the bottom line. A data-driven approach to materiality provides a more objective and unbiased view of materiality, helping companies to better understand their impact on the world around them and make evidence-based decisions.

ESRS 1 and 2, core reporting standards within the CSRD, stress a couple of characteristics of a solid materiality process. These are prerequisites that ‘traditional’ (stakeholder-based) materiality processes are having a hard time complying with.

-

Risk and opportunity-based: Companies should evaluate the materiality of sustainability topics according to the risks and opportunities they generate for businesses. This requires thorough, sector-specific, analyses of how (mega)trends, like climate change, circular economy, and diversity, play out in a given industry.

-

Forward-looking: CEOs and other strategic thinkers generally have problems with sustainability managers presenting materiality analyses. They are too narrow and backward-looking. To win in the coming decade, companies must equip themselves with a forward-looking and proactive approach to materiality that can work in the mid and long term.

-

Dynamic: Executive teams are transforming strategic planning processes from things that happen once every 3-5 years to a quarterly frequency. A materiality analysis that wants to inform corporate strategy should follow this pace. It should be flexible enough to run in shorter time intervals, hence from static to dynamic.

-

Value chain perspective: Traditional materiality processes rely heavily on what internal stakeholders within the company think and say. Double materiality requires your organisation to adopt a view across the value chain. This entails integrating a vast amount of information, data, views, etc… an information overload the human brain can hardly fathom, structure, or interpret.

To win in the coming decade, investors and companies must equip themselves with forward-looking and proactive approaches to materiality (World Economic Forum).

The characteristics described are hardly reconcilable with traditional materiality processes that are manual, stakeholder-based (and hence subjective), and very time-consuming. Enter dynamic and data-driven materiality using strategic intelligence platforms.

A tangible approach to dynamic, data-driven materiality

Companies are faced with the challenge (but also have the opportunity) of analysing a vast amount of data to inform materiality analyses. What if we could use the power of advanced analytics (encapsulated in a digital companion) to support ESG executives and sustainability managers in double materiality processes that are more representative, objective, forward-looking, and efficient?

Advanced analytics can help to estimate the degree of influence a certain (ESG-)trend or topic has on a company in a given industry – with associated strength and ‘time to impact’. This can be done by analysing millions of data points from a variety of sources, including news articles, regulatory filings, patents, sustainability disclosures of peers and customers, and social media. Advanced analytics platforms, like the Trensition Trendtracker for ESG materiality, typically use AI and natural language processing to make sense of all these disparate data sources. At the same time, they can complement other materiality steps organisations take, like internal stakeholder engagement or interpreting LCA results.

Double materiality requires organisations to, not only, estimate the financial and impact materiality of ESG issues – but also pinpoint why and how they are material. This entails, rigorously, identifying risks, opportunities, and impacts. Advanced analytics platforms can give companies the necessary insights into how certain ESG trends materialise in a certain industry, by giving clear proof points of materiality. For example by hinting towards key moves of competitors, spotting upcoming regulatory proposals, or detecting shifting customer perceptions or demands.

What if we could use the power of advanced analytics (encapsulated in a digital companion) to support ESG executives and sustainability managers in double materiality processes?

To conclude, we feel that using a data-driven approach to materiality enables companies to fill some wanted gaps in traditional materiality processes, and live up to the double materiality principle. It allows the identification of emerging or potential ESG trends and issues that may not have been on companies’ radars previously. Additionally, it provides a more objective and unbiased view of materiality, as it is based on data rather than the opinions of internal stakeholders.

.jpg?width=3340&height=5000&name=pexels-fauxels-3183185%20(1).jpg)